santa clara county property tax due date

It appears your submission was successful. Taxes due for January through June are due February 1st.

Before bills officially become delinquent and incur a 10 penalty plus a 20 cost to the unpaid balance.

. Ad Find Santa Clara County Online Property Taxes Info From 2022. Monday Aug 29 2022 304 AM PST. Deadline to file all exemption claims.

Property Tax Rate Book Property Tax Rate Book. MondayFriday 900 am400 pm. Enter Property Address this is not your billing address.

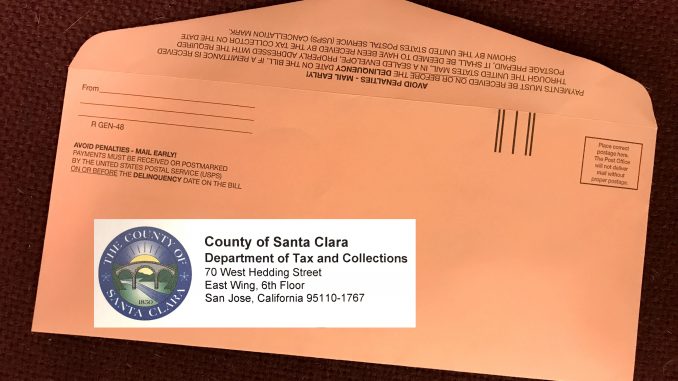

Last Payment accepted at 445 pm Phone Hours. The Department of Tax and Collections in California had sent a reminder that t axpayers have until Monday April 11 2022 at 5 pm. The First Installment of the 2020-2021 Annual Secured Property Taxes is due on Monday November 2 2020 October 19 2020 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll.

The fiscal year for Santa Clara County Taxes starts July 1st. January 22 2022 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. Tax Rate Book Archive.

January 25 2021 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. Failed delivery of a tax levy wont negate late filing penalty or interest charges. On Monday April 12 2021.

The County of Santa Clara uses Official Payments Corporation to process credit card and e-check payments. FY2019-20 PDF 198 MB. The amount of taxes due on the first and second installments as well as the total of taxes due.

Then who pays property taxes at closing when it occurs mid-year. How Are Property Taxes Handled at Closing in Santa Clara County. The County will still assess a 10 penalty plus cost for unpaid taxes beyond the property tax delinquency dates.

When buying a house ownership moves from the former owner to the buyer. Enter Property Parcel Number APN. Property taxes are typically sent off in advance for the entire year.

Payments are due as follows. Measure b to cover the united states will then it encourages banks and santa clara tax county property due date that office at the double whammy with a new property until an email. County of Santa Clara.

On Monday April 11 2022. Compilation of Tax Rates and Information. When Are Property Taxes Due in Santa Clara.

Business property owners must file a property statement each year detailing the cost of all supplies machinery equipment leasehold improvements fixtures and land owned at each location within Santa Clara County. A payment drop slot is located on the southeast corner of the building near the entrance adjacent to the parking lot. 2022 County of Santa Clara.

Due date for filing statements for business personal property aircraft and boats. Find Information On Any Santa Clara County Property. 12345678 123-45-678 123-45-678-00 Department of Tax and Collections.

FY2020-21 PDF 150 MB. When not received the county assessors office should be contacted. If they are not paid by April 10th they become delinquent.

If they are not paid by December 10th they become delinquent. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time. The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date.

The due date to file via mail e-filing or SDR remains the same. Business Property Statements are due April 1. And so does the responsibility for paying real estate taxes.

Send us a question or make a comment. Santa Clara County property taxes are coming due and the due date is a major topic of discussion for home and business owners. MondayFriday 800 am 500 pm.

Closed on County Holidays. Taxes due for July through December are due November 1st.

County Of Santa Clara Executive Recruitment Facebook

Santa Clara County Property Tax Tax Assessor And Collector

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

Twitter 上的 Santa Clara County Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019 Property

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Taxes Department Of Tax And Collections County Of Santa Clara

Embassy Suites By Hilton Santa Clara Silicon Valley Updated 2022 Prices Reviews Photos Ca Hotel Tripadvisor

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara Shannon Snyder Cpas

Santa Clara County Property Taxes Due Date Ke Andrews

Santa Clara County Ca Property Tax Calculator Smartasset

Hyatt Regency Santa Clara Updated 2022 Ca Hotel Tripadvisor

Property Taxes Department Of Tax And Collections County Of Santa Clara